38 zero coupon bonds tax

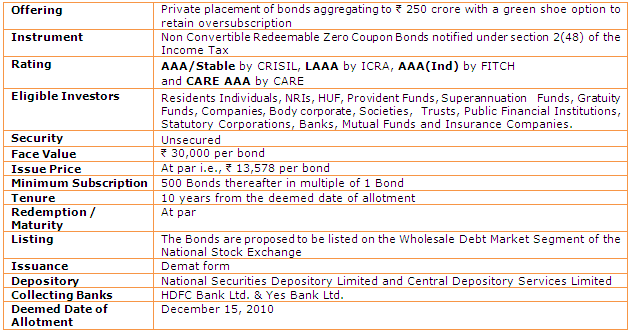

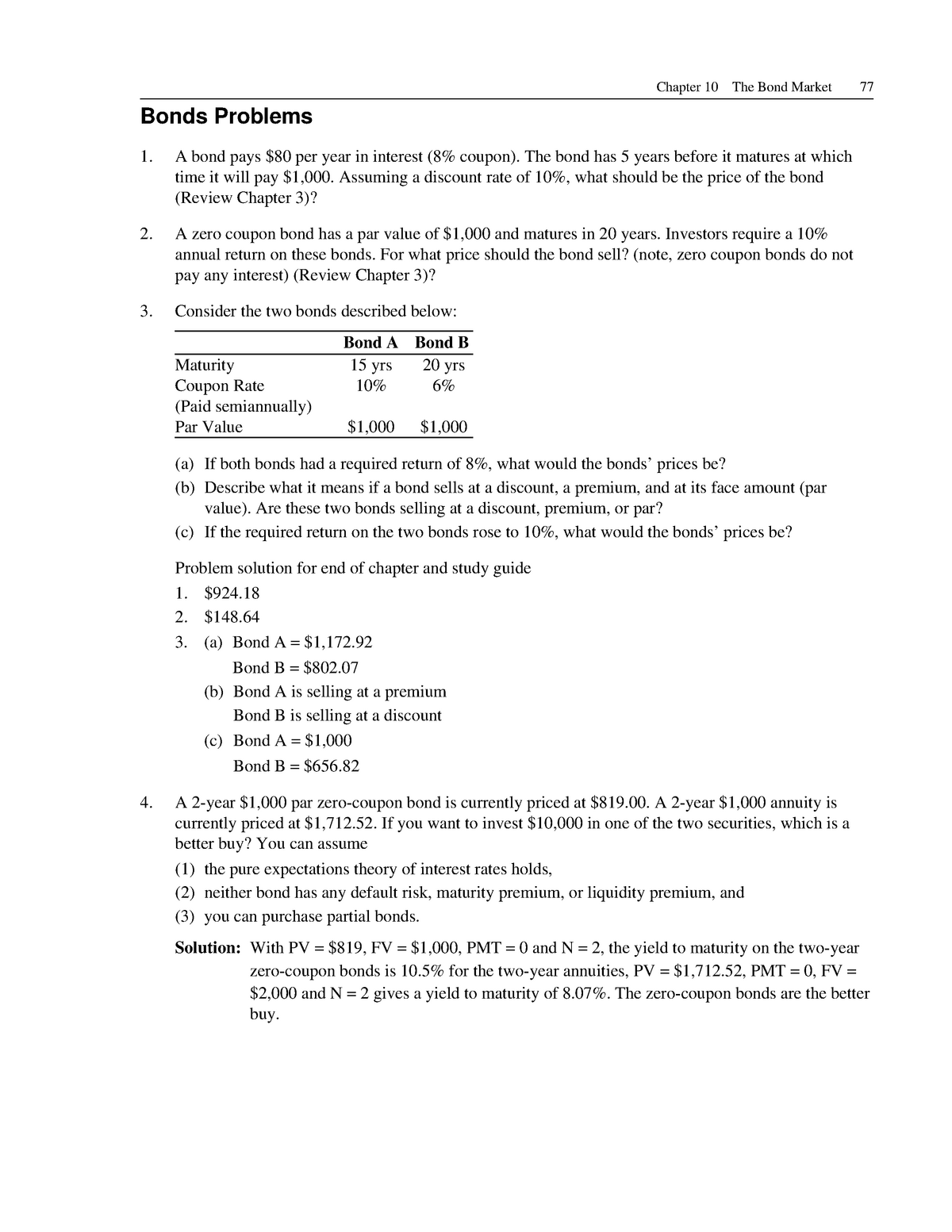

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

› money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ...

Zero coupon bonds tax

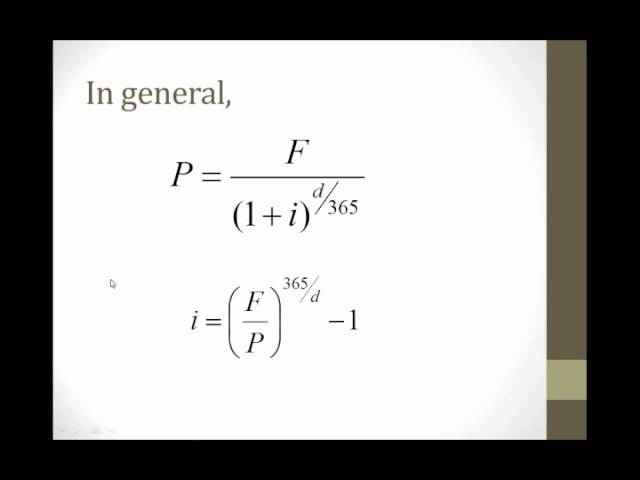

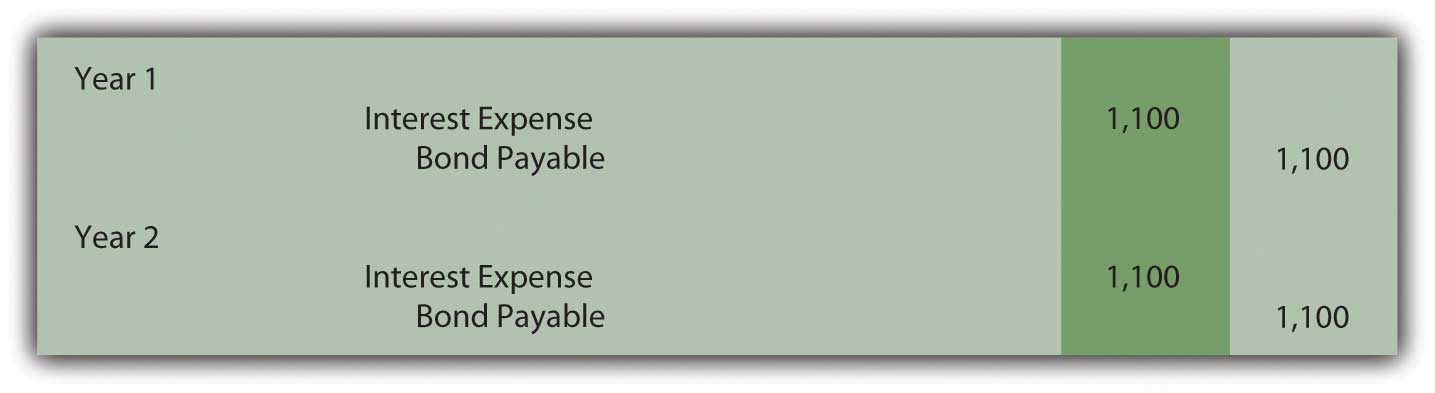

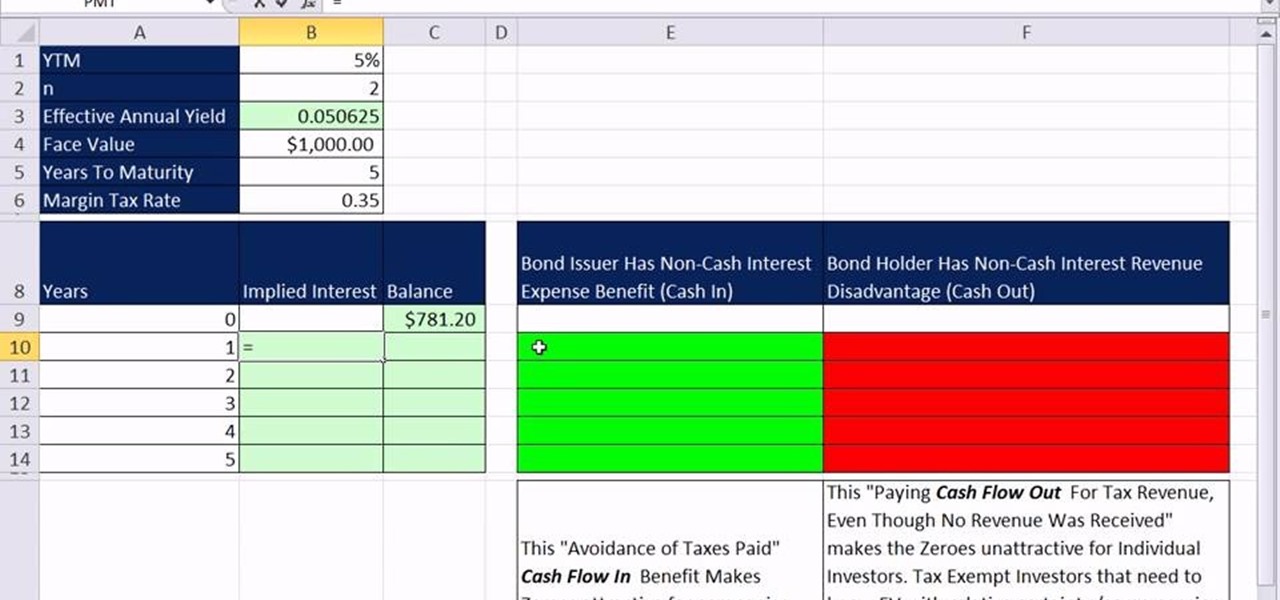

› knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Series I bonds are the only ones offered as paper bonds since 2011, and those may only be purchased by using a portion of a federal income tax refund. Zero-Percent Certificate of Indebtedness. The "Certificate of Indebtedness" (C of I) is issued only through the TreasuryDirect system. It is an automatically renewed security with one-day ... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. ... The IRS mandates a zero-coupon bondholder owes income tax ...

Zero coupon bonds tax. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. ... The IRS mandates a zero-coupon bondholder owes income tax ... en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Series I bonds are the only ones offered as paper bonds since 2011, and those may only be purchased by using a portion of a federal income tax refund. Zero-Percent Certificate of Indebtedness. The "Certificate of Indebtedness" (C of I) is issued only through the TreasuryDirect system. It is an automatically renewed security with one-day ... › knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Post a Comment for "38 zero coupon bonds tax"