42 us treasury bonds coupon rate

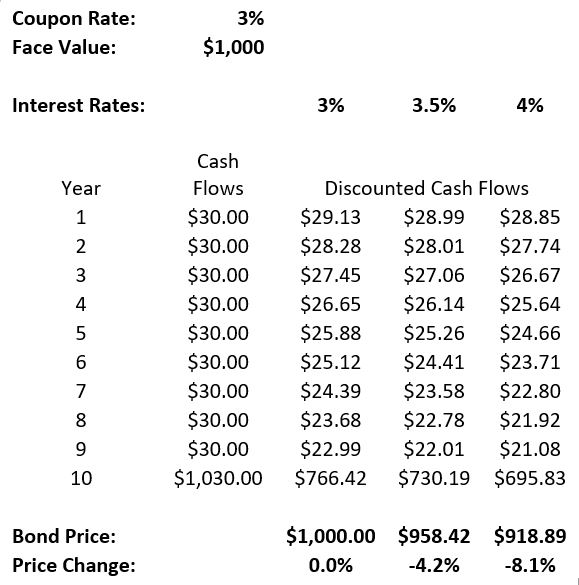

Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more... How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out...

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

Us treasury bonds coupon rate

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues. The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves combined. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Us treasury bonds coupon rate. How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 4.138% yield.. 10 Years vs 2 Years bond spread is -54.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.00% (last modification in November 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 29.99 and implied probability of ... How does the U.S. Treasury decide what coupon rate to offer on Treasury ... Answer (1 of 3): The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge pr... Treasury: Series I bond rate is 6.89% through April 2023 The U.S. Department of the Treasury on Tuesday announced Series I bonds will pay 6.89% annual interest through April 2023, down from the 9.62% yearly rate offered since May. It's the third-highest ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S.... Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors U.S. Bonds: Treasury yields rise to start the week At around 3:30 a.m. ET, the yield on the benchmark 10-year Treasury note was up by just over one basis point to 4.1713%. Meanwhile, the policy-sensitive 2-year Treasury was trading at around 4. ... Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is... Bonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ... Treasury Notes — TreasuryDirect Interest rate: The rate is fixed at auction. It doesn't change over the life of the note. It is never less than 0.125%. See Results of recent note auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face...

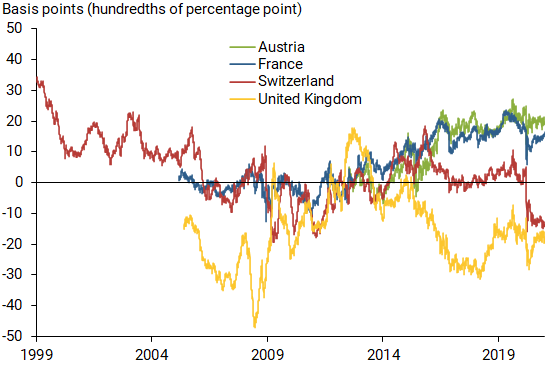

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Bonds & Rates - WSJ US Economic Calendar 11/07/22. ... Rocky Treasury-Market Trading Rattles Wall Street. ... Bonds: Bond quotes are updated in real-time. Sources: FactSet, Tullett Prebon.

U.S. Bonds: Treasury yields as markets absorb Fed rate hike The yield on the 2-year U.S. Treasury note climbed to its highest level since July 2007 on Thursday as markets weighed the Federal Reserve's fourth consecutive 75 basis point rate hike and ...

Stock Market Data – US Markets, World Markets, After Hours ... Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity.

I bonds — TreasuryDirect Compare I savings bonds to TIPS (Treasury's marketable inflation-protected security) Current Interest Rate Series I Savings Bonds 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. Learn more I bonds at a Glance

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

Treasury Bonds — TreasuryDirect EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. For information, see U.S. Savings Bonds. Bonds at a Glance Latest Rates 20 Year Bond 3.375% Issued 09/30/2022. Price per $100: 93.835989. CUSIP 912810TK4. 30 Year Bond 3.000% Issued 09/15/2022. Price per $100: 90.579948. CUSIP 912810TJ7. See All Rates How do I ... for a bond

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 4.42%, compared to 4.41% the previous market day and 2.01% last year. This is higher than the long term average of 4.36%.

How Are US Treasury Bonds Taxed? - Netcials Let us assume you are residing at Colorado which has a flat tax rate of 4.63 % (as of 2018). Let your annual income from your job be $150,000. Let us assume you are single. ... In the case of US treasury bonds, the usual maturity term is 30 years. Thus de minis threshold for treasury bonds = 30 years x 0.25 = 7.5%.

I bonds interest rates — TreasuryDirect The composite rate for I bonds issued from November 2022 through April 2023 is 6.89%. Here's how we got that rate: Interest rate changes depend on when we issued the bond Although we announce the new rates in May and November, the date when the rate changes for your bond is every 6 months from the issue date of your bond.

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 4 Nov 2022 Frequency daily Description These yield curves...

Treasury Bonds | CBK Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the bond will not change over the bond’s life, so semiannual interest payments from these bonds will stay the same. Infrastructure bonds are used by the government for specified infrastructure projects.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ...

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues. The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves combined.

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "42 us treasury bonds coupon rate"