39 duration of a coupon bond

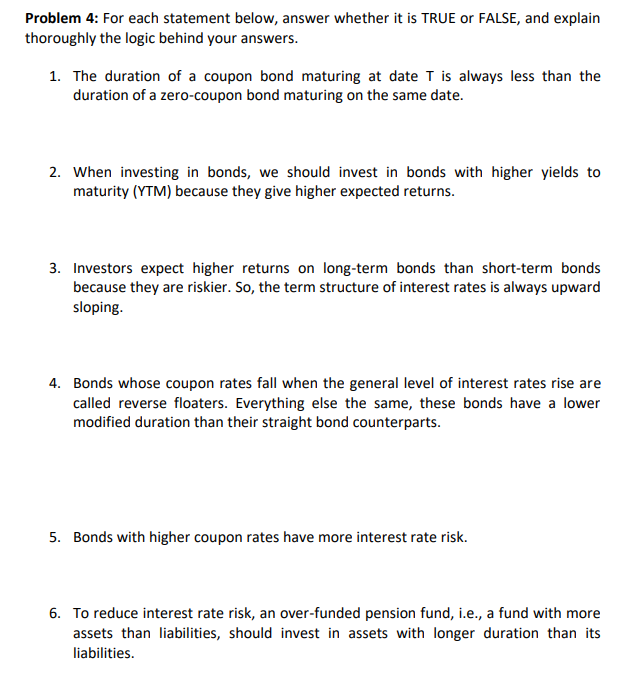

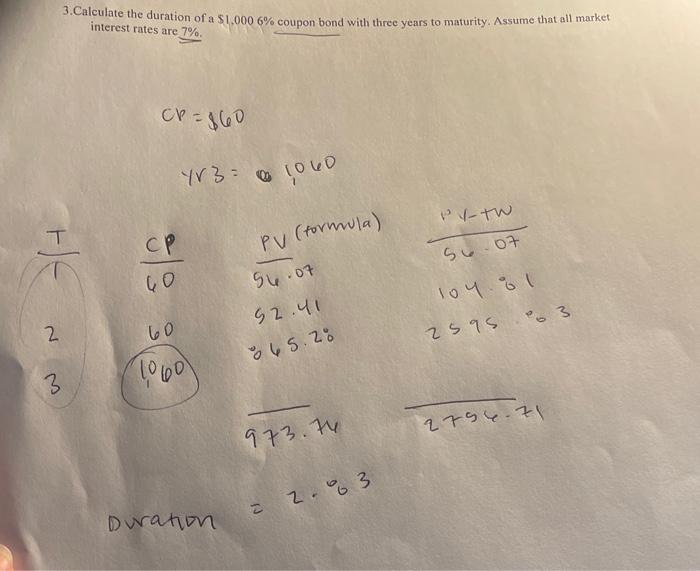

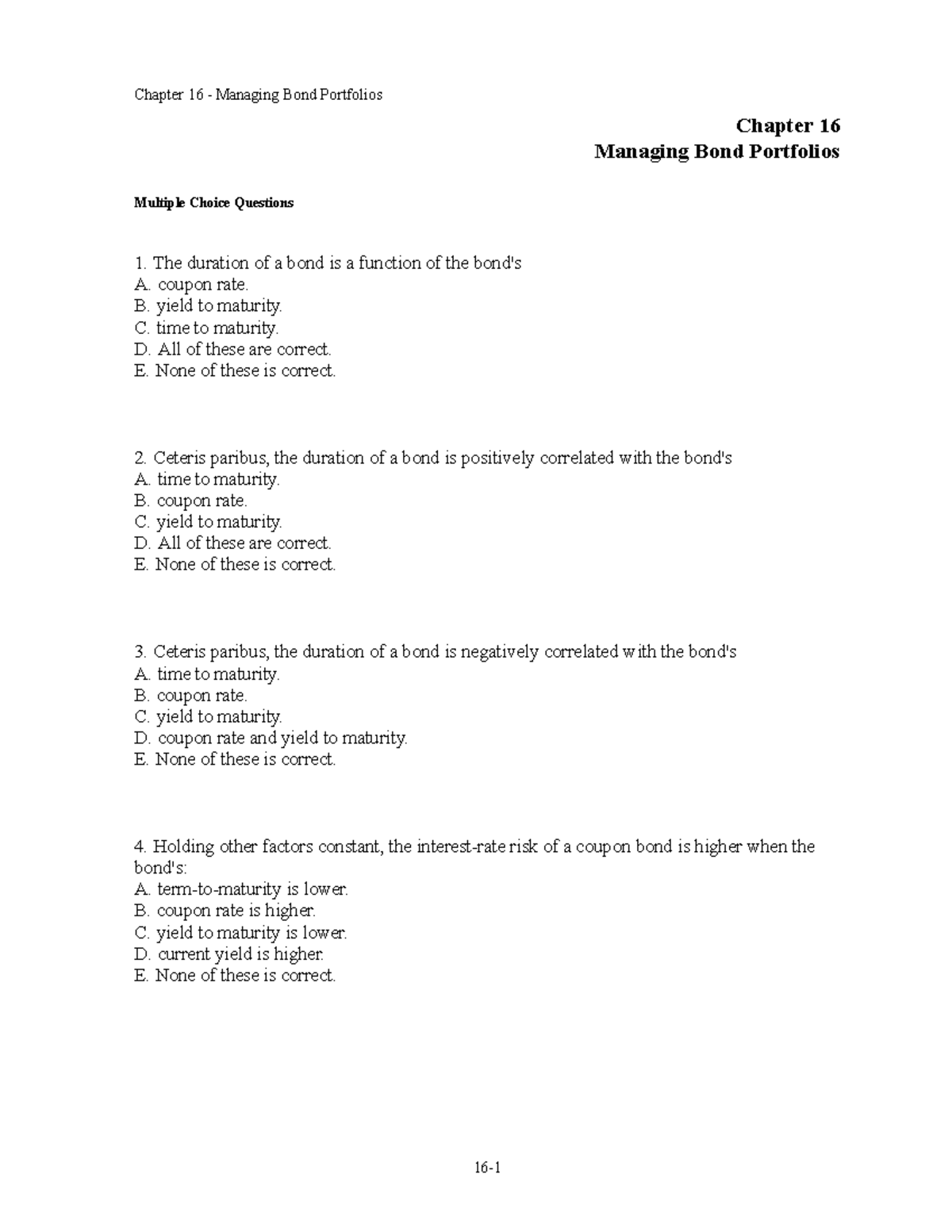

Bond Duration Calculator - Exploring Finance The bond duration calculator can be used to calculate the bond duration. Example is included to demonstrate how to use the calculator. ... Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years; t 2 = 1 years; t 3 = 1.5 years; Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity In the bond duration example, we computed the duration for a made up bond. Let's use the same example and compute convexity: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5%; Years to Maturity: 3; Coupon Payouts: One a Year; Duration, Modified Duration: 2.856, 2.682 (Note: this calculation is in the bond ...

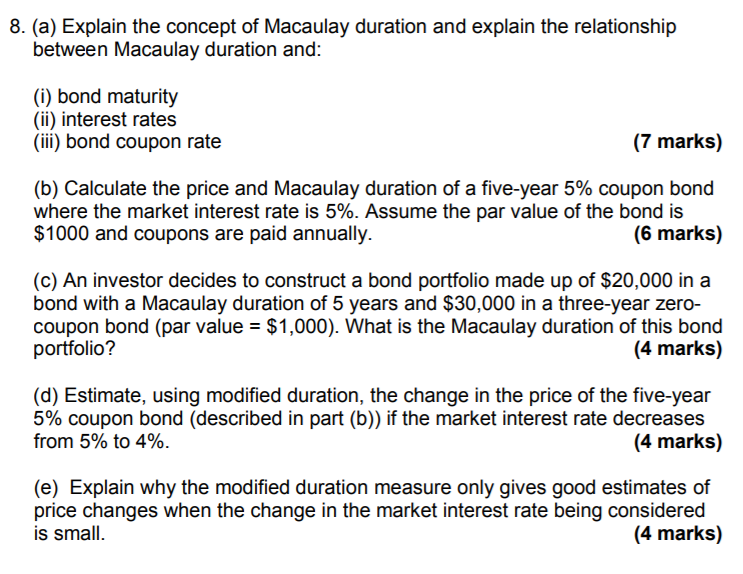

Duration of a coupon bond

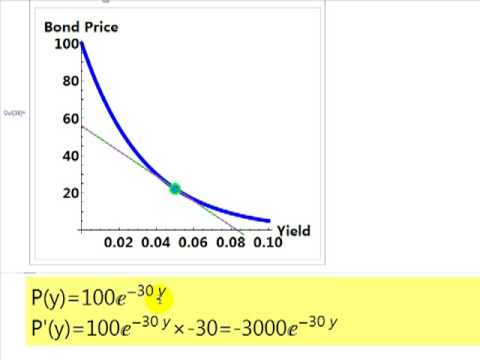

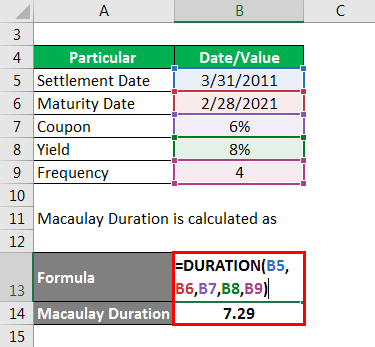

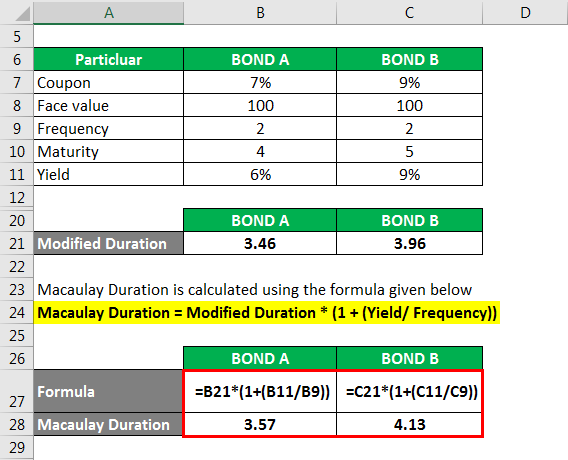

Duration Definition and Its Use in Fixed Income Investing - Investopedia Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000... Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out.

Duration of a coupon bond. PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of What Is Bond Duration? Definition, Formula & Examples When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates, a bond's price will decrease 1% for every year of duration. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Duration for a zero-coupon bond.xlsx - Table of Content... View Duration for a zero-coupon bond.xlsx from BUSINESS 200916 at Western Sydney University. Table of Content Zero Coupon Bond Price Duration and Convexity Exercise Strictly Confidential Notes This

Bond Duration - Management Study Guide The duration of a zero-coupon bond is equal to its maturity. This is because zero-coupon bonds only pay one single cash flow. This cash flow is paid on maturity and hence the duration is higher which makes sensitivity to interest rates also go higher. The duration of a bond that pays coupons earlier has a shorter duration. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. The dynamics of bond duration and rising rates | Vanguard Nov 18, 2021 · Your investment horizon matters. Rising interest rates can be good for bond investors if their investment horizon is long enough. Figure 1 shows the effect of the investment horizon on a hypothetical investment in a bond maturing in 15 years that pays a coupon of 0.9% annually when interest rates are at 2%. The bond’s weighted average Macaulay duration is 14 … Bond Duration Calculator – Macaulay and Modified Duration From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

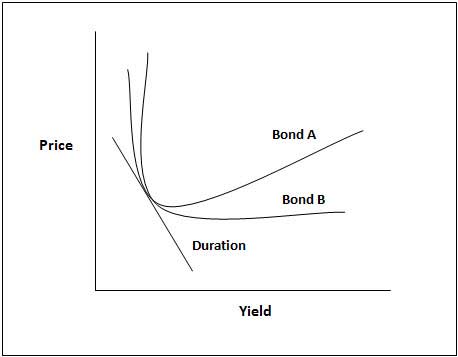

Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%. What Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates ...

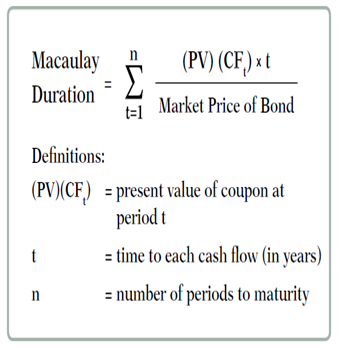

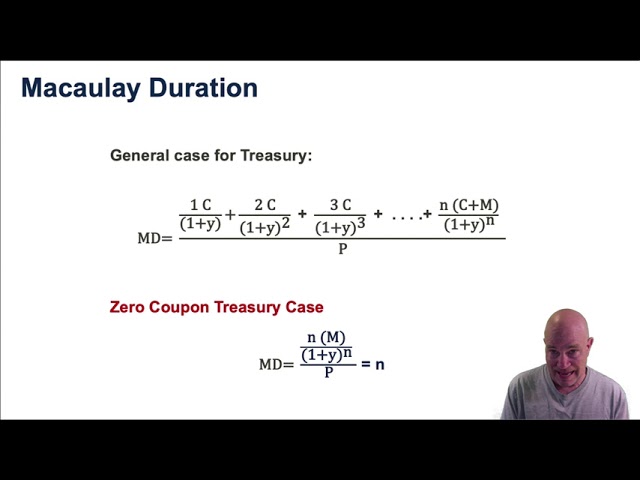

Duration - Definition, Types (Macaulay, Modified, Effective) It is a measure of the time required for an investor to be repaid the bond's price by the bond's total cash flows. The Macaulay duration is measured in units of time (e.g., years). The Macaulay duration for coupon-paying bonds is always lower than the bond's time to maturity. For zero-coupon bonds, the duration equals the time to maturity.

Convexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high; While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

Macaulay Duration: Definition, Formula, Example, and How It Works Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ...

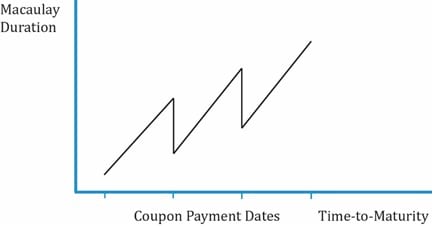

Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity.

Bond Duration Calculator - Exploring Finance PV= Bond price = 963.7 FV= Bond face value = 1000 C= Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4=tn= 2 years

How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder).

What is the duration of a bond? and How to Calculate It? Usually, the duration of a bond shows the number of years in which an investor can recover the present value of the cash flows of a bond. It can also represent a percentage that is a measure of how sensitive the value of the bond is to changes in interest rates. The duration of a bond is simple to understand.

Understanding the Relationship Between Coupon Rates and Duration A high coupon rate bond provides more cash flow than a low coupon rate bond. Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures.

What is the duration of a bond? and How to Calculate It? The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc.

Duration Formula (Excel Examples) | Calculate Duration of Bond Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of ...

Zero coupon bond interest rate - uhk.magicears.shop The duration of a zero - coupon bond (duration measures a bond's interest - rate sensitivity) is more or less equal to its maturity. The five-year STRIP's duration was 5.14 years; the long STRIP's was. ... Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the ...

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out.

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Duration Definition and Its Use in Fixed Income Investing - Investopedia Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/Duration_final-5225be866f9543a9b4b957620c475cd5.png)

Post a Comment for "39 duration of a coupon bond"