44 calculate coupon rate in excel

Coupon Rate Template - Free Excel Template Download Coupon Rate Formula. The formula for calculating the coupon rate is as follows: Where: C = Coupon rate. I = Annualized interest. P = Par value, or principal amount, of the bond. More Free Templates. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document ... How to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel. The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2. Select a blank cell, for instance, the Cell C2, type this formula = (B2-A2)/ABS (A2) (the Cell A2 indicates the original price, B2 stands the sales ...

How to Calculate Bond Price in Excel (4 Simple Ways) 4 Easy Way to Calculate Bond Price in Excel. Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Method 2: Calculating Bond Price Using Excel PV Function. Method 3: Calculating Dirty Bond Price. Method 4: Using PRICE Function to Calculate Bond Price. Conclusion.

Calculate coupon rate in excel

How to calculate Spot Rates, Forward Rates & YTM in EXCEL c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond). Zero-Coupon Bond: Formula and Excel Calculator If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Coupon Bond Formula | Examples with Excel Template Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

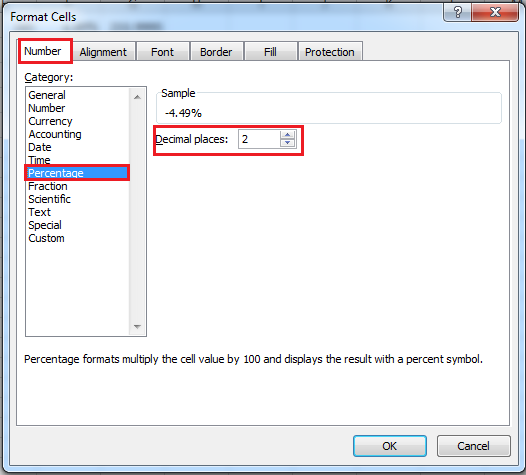

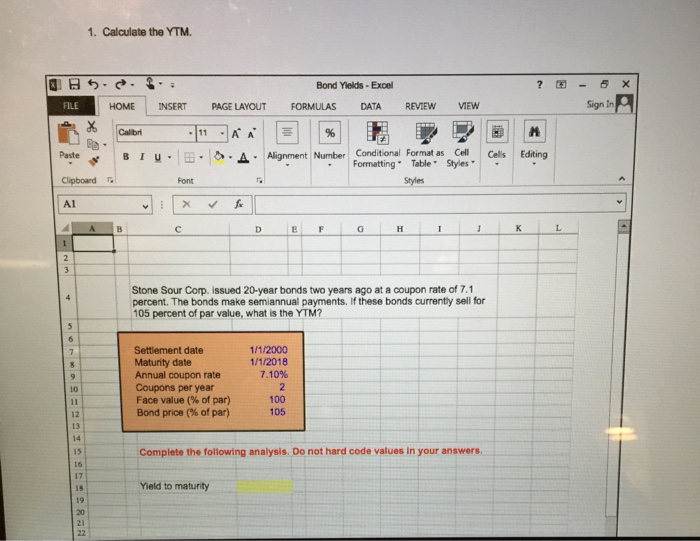

Calculate coupon rate in excel. How to calculate years to maturity in excel 5. 20. · The formula used to calculate a bond's modified duration is the Macaulay duration of the bond divided by 1 plus the bond's yield to maturity divided. To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., A1 through A3). In cell A4, enter the ... Using Excel formulas to figure out payments and savings to save $8,500 in three years would require a savings of $230.99 each month for three years. The rate argument is 1.5% divided by 12, the number of months in a year. The NPER argument is 3*12 for twelve monthly payments over three years. The PV (present value) is 0 because the account is starting from zero. The FV (future value) that you want ... Calculate a Forward Rate in Excel - Investopedia This can be otherwise written as "= (100 x 1.04)" in Excel. It should produce $104. The final two-year value involves three multiplications: the initial investment, interest rate for the first ... Microsoft Excel Bond Yield Calculations | TVMCalcs.com This can be tedious to do by hand. Fortunately, the Rate() function in Excel can do the calculation quite easily. Technically, you could also use the IRR() function, but there is no need to do that when the Rate() function is easier and will give the same answer. To calculate the YTM (in B14), enter the following formula: =RATE(B5*B8,B3/B8*B2 ...

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a ... How to calculate bond price in Excel? - ExtendOffice Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can ... How can I calculate a bond's coupon rate in Excel? How to Find the Coupon Rate. In Excel, enter the coupon fee in cell A1. In cell A2, enter the variety of coupon funds you obtain annually. If the bond pays curiosity as soon as a yr, enter 1. If you obtain funds semi-annually, enter 2. Enter four for a bond that pays quarterly. In cell A3, enter the method =A1x A2 to yield the entire annual ...

Bonds Calculate Coupon Rate - YouTube how to calculate coupon rate on a bondexamples using excel and financial calculator Using RATE function in Excel to calculate interest rate Monthly payments: nper = years * 12. Quarterly payments: nper = years * 4. To get an annual interest rate, multiply a periodic interest rate returned by the function by the number of periods per year. Monthly payments: annual interest rate = RATE () * 12. Quarterly payments: annual interest rate = RATE () * 4. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value ... How to calculate YTM in Excel | Basic Excel Tutorial Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Write the following words from cells A2 -A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price. 3. Format the column width in the excel sheet so that it is wide enough to accommodate all characters.

Excel formula: Bond valuation example | Exceljet The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. Finally, the required rate of return (discount rate) is assumed to be 8%.

How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ...

Calculating Accrued Interest on a Bond in Excel | Example ACCRINT is the Excel function that calculates the interest accrued on a bond between two coupon dates. ACCRINT calculates accrued interest by multiplying the coupon rate with the face value of the bond and the number of days between the issue date or the last coupon date and the settlement date and dividing the resulting figure by the total days in a coupon payment.

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Post a Comment for "44 calculate coupon rate in excel"